Calculate your freelance rate

You have almost been given the job, the negotiations are going smoothly, and you can convince the client that you are the perfect freelancer to assist his company. And then: the inevitable question: ‘What’s your rate?’ On the one hand, if your rates are too low, the quality of your work may be perceived as inadequate but, on the other hand, you don’t want to scare away potential clients with rates that appear too high. Not only starters are uncertain of the correct rates for their services, veteran freelancers often ask us for advice with regard to their rates, too. Continue reading to learn everything you should know about setting your rates.

Calculate your minimum wage

Launching your career as a freelancer starts with calculating the right rate. Calculating your rate is actually quite simple, given the basic rules. Start by calculating the minimum wage you would ask for the job you do. Start by compiling an overview of the recurring expenses you expect to incur. After all, recurring expenses will need to be paid for, even if you aren’t working. If you are a graphic designer, for example, this would include your monthly invoice for Adobe or the cost price of a good computer. Sales representatives, on the other hand, will probably include car costs. If you choose to work from home, you could include the cost of furnishing your office. These costs can be as extensive as you like, so it is important to create the most complete overview possible of your expenses.

The next step is to make an estimate of your incidental expenses. In comparison to recurring expenses, these are dynamic and will vary depending on the assignment. They can include fuel for your car, or simply all the litres of coffee you are pouring down your gullet to keep up your concentration. Although these costs are largely assignment-specific, compiling an estimate of these expenses is certainly to your advantage. The more experience you have as a freelancer, the easier it will be for you to gain insight into the expenses you actually incur.

Gross or nett: calculating your net rate

So, you have calculated your costs. What now? In this step, you will determine what you want to earn in a year. Net monthly earnings of 1,700 euros translate into annual earnings of 20,400 euros. Let’s add the total costs to this amount. Because you, as a self-employed person or one-man (or one-woman) business need to pay your own social security contributions. You have to keep in mind that once your taxes and social security contributions have been deducted this will leave you with around 50% of your earnings. This will vary depending on the company form under which you set up your freelance business, but 50% is a good estimate. We, therefore, recommend increasing your net rate, together with your expenses, twofold so that you won’t run into any unpleasant surprises.

Working nine to five?

In Step 2, we calculate the number of days per year that you will be working. A driven freelancer lives according to the ‘work hard, play hard’ principle. That’s why it is important not to forget your holiday in Ibiza when calculating your rates. So, subtract 20 holiday days from the 260 days on which you can work. Subtracting another 5 to 10 days of sick leave from this is no unnecessary luxury either (unless you absorbed enough Vitamin Sea on Ibiza, of course). As a freelancer, you obviously won’t always have work when you want it. Finding appropriate projects remains one of the biggest challenges facing freelancers. The broader your network, the easier it is to make use of your own circle of acquaintances. Of course, you can be guaranteed more projects through a digital network like GIGHOUSE, but we’ll save that sales pitch for our adverts :). The moral of the story: Be realistic when determining how many days you plan to work.

Example:

We calculated the gross rate and decided how many days a year we want to work. When you divide these figures, the product is the minimum wage. The genuine Sherlocks among you have already figured this out. If you divide this amount by the number of hours you want to work in a day, the product of this equation will be your minimum hourly rate. Got it? It sounds a lot more complicated than it really is, so here is an example:

Freelance copywriter Ellen wants to earn 1800 euros a month. Her recurring expenses are 2000 euros a year. She also has incidental expenses amounting to 100 euros a month. She wants to take 20 days off a year, and reserves 10 days to take off in case she becomes ill.

(Net annual wages to earn + total costs) x 2 / Number of days you want to work =

((1800 X 12) +( 2000 + 1200)) x2 /230= €215,65

Next, divide this amount by the number of hours that you want to work in a day, and you will single-handedly have calculated your minimum hourly rate.

What are some other determining factors with regard to your freelance rate in 2019?

Now that you know your bottom line, you can start gradually raising your rate. The various rungs on this ladder are Branch of industry, seniority level, the type of job, the client’s industry and the rates charged by your fellow freelancers. An overview:

1) The client’s industry.

The budgets of your clients are strongly dependent on the industry in which they operate. Always keep an eye on your client’s spending power. The budget of a small-scale SME in the pharmaceutical industry will be higher than that of a non-profit organisation. However, that does not mean that you need to go far below your own budget for clients with smaller budgets. You will simply need to recalculate.

2) The branch of industry in which you are active

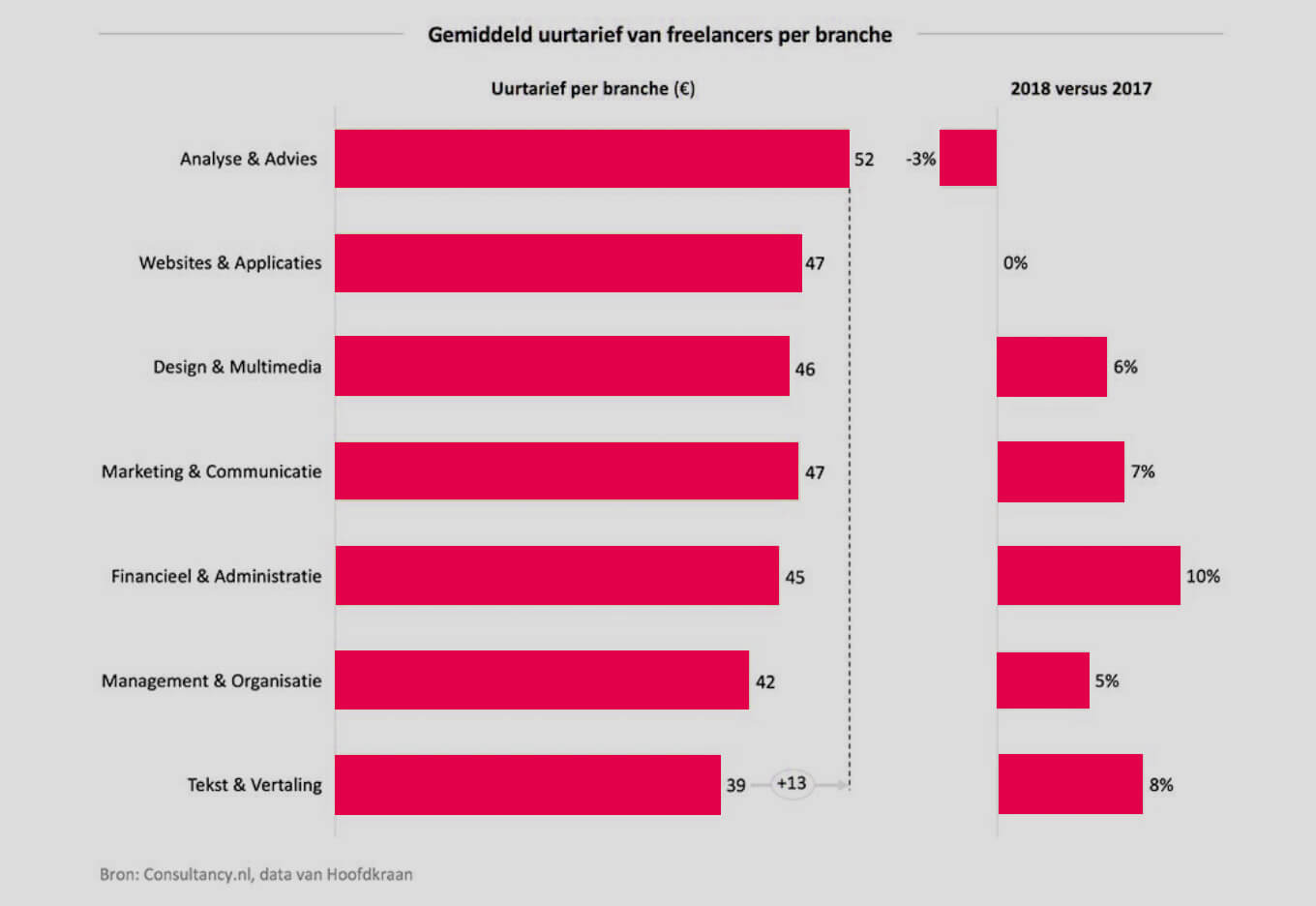

Do you provide HR advice to multinational corporations, or are you translating an SME’s new website? Here too, it’s best to refer to your own core business. To compensate for a lack of recent figures concerning the market prices of freelancers in Belgium in 2019, let’s pay a visit to our Dutch neighbours. The following overview (per branch of industry) is a good starting point.

3) Experience

The more experience you have with certain skills, or your years of experience in a given industry are all important factors to take into consideration when setting your price. Someone whose profile reveals a certain degree of seniority can use his/her experience to leverage a higher fee than that of someone who is his/her junior. A golden tip is Ericsson’s Rule. According to this rule, it takes 10,000 hours to become an expert in a given skill. In the corporate world, this is often translated as a milestone equal to five years’ experience. If you can present your client with appropriate references that clearly demonstrate your level of experience, this will provide a clear indication of what you’re worth, so don’t hesitate to do this!

4) Freelancing competitors

In the very last phase, it can be a good idea to compare your rates to those of other freelancers. Please note that you should do this only in the last phase. After all, you know what you are worth, and what you need to earn in order to pay your recurring and other expenses. It might be tempting to apply the same rates as another freelancer you know, but that would mean that you are basing them on someone else’s estimate. So, use your competitors’ rates as a benchmark, but not as a standard! In order to quickly give you a good idea of the applicable rates, we would like to give you the following information. In 2104, the average freelancer in Belgium applied an hourly rate of 56 euros. Unfortunately, the relevant figures are not available for 2019 in Belgium. In the Netherlands, clients paid an average of 46 euros an hour when hiring a freelancer. The average hourly rate is a few euros less across the border.

Freelance tips

Congratulations! You are now armed with all the information you need to set a well-considered price. Here are two tips to help you keep a vigilant eye on your rates:

1) If your client thinks your rate is too high, you can offer to cut back on the number of duties you are asked to perform or to spend fewer hours on a given task. This way, you can be assured of being able to pay your expenses and this shows that your price is, essentially speaking, not negotiable.

2) Recalculate your rates at least once a year. Many of the factors that determine your rates are dynamic. Make sure your rates remain in line with these developments!